Product

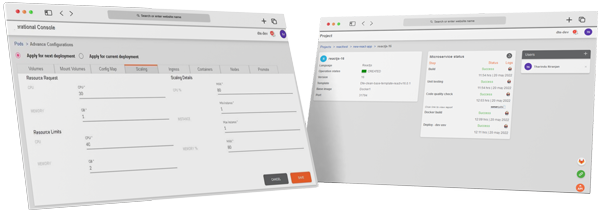

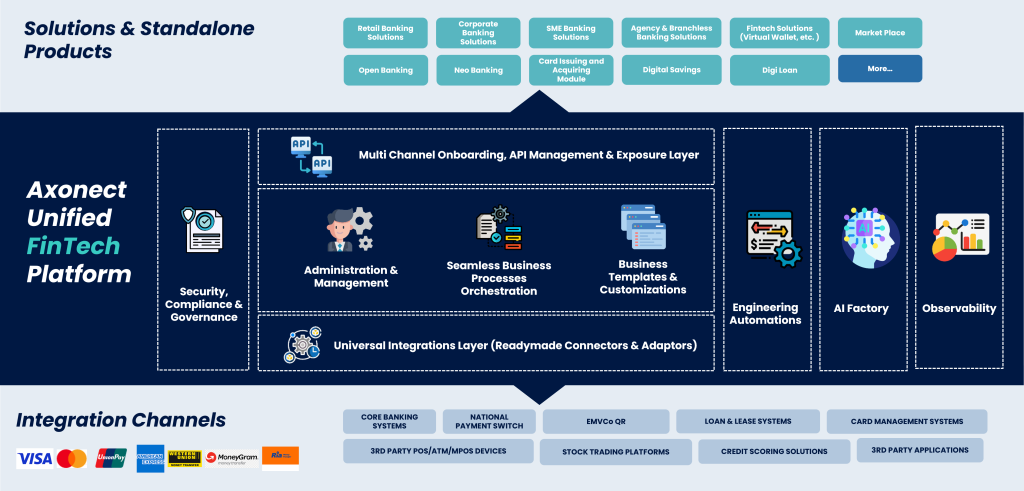

Axonect Unified Fintech Platform

Elevate your financial services with the Axonect Unified Fintech Platform, an all-in-one digital solution for banks and financial institutions. Our plug-and-play system consistently enhances partners’ digital infrastructure, improving profitability, risk management, and operational efficiency.